Auckland economic update October 2025

Author:

Ross WilsonSource:

Auckland Council Social and Economic Research and Evaluation TeamPublication date:

2025Topics:

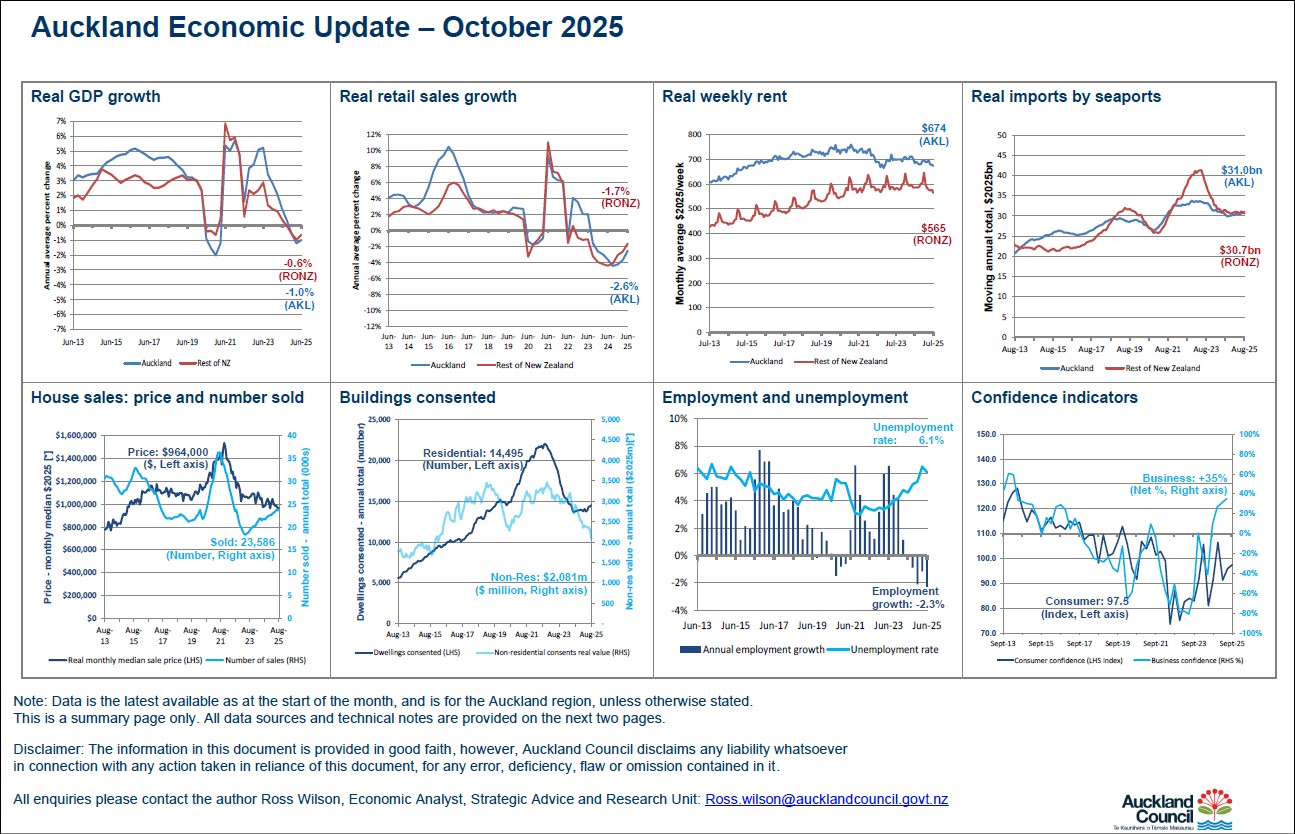

EconomyAn overview of the Auckland economy for October 2025, in charts and graphs and with some commentary.

Measures covered: house prices and numbers sold, weekly rents, building consents, employment and unemployment, GDP, business and consumer confidence, retail sales, imports.

Highlights include:

- Consumer confidence for the quarter ended September 2025 quarter was 97.5: above most of 2022-2025 and mid-2020, but below most of 2009-2021;

- median house price for the month of August 2025 was $964,000 (in real* dollars: the lowest since January; falling continuously since March; the lowest-equal since 2015, ten years ago; 36% below 2021’s all-time peak);

- number of houses sold for the year ended August 2025 was 23,586: similar to recent months; trending up since the May 2023 trough; slightly above 2017-2019; but 34% below the July 2021 peak;

- average weekly rent for the month of July 2025 was $674 (in real* dollars: 2% below a year ago; the lowest since late 2022; the same as ten years ago). For the rest of New Zealand, the figure was $565: 4% below a year ago; slightly below most of the last four years (but highly seasonal); 3% above five years ago;

- number of new dwellings consented in the year ended August 2025 was 14,495: 5% above a year ago; mostly rising for the last year; 34% below the September 2022 peak; 4% below the 2019 pre-Covid peak;

- real* value of new non-residential buildings consented in the year ended August 2025 was $2,081 million: 10% below July; 29% below a year ago; 40% below the 2022 peak; 9% below the 2020 trough; and the lowest since the start of 2016;

- real* value of imports by Auckland seaports for the year ended August 2025 was $31.0 billion: rising slightly over the last year, still 8% below April 2023, but 18% higher than the 2020 Covid trough. For the rest of New Zealand, the figure was $30.7 billion: similar to the last year, 19% above the 2020 trough, and 26% lower than their 2023 post-Covid rebound peak.

*Note: real dollars/values are after adjusting for the effects of inflation each quarter, so a similar ‘real’ level means that a value rose at a similar rate to inflation.

October 2025

Previous updates.

2024